CEO Memo - June 2023

Hi Everyone,

Happy end of June! We are into the back half of the year as we roll into July, and it definitely feels like everyone I talk to is head down, bum up.

We had another solid month with lead generation; the strongest we have had all year (with no change in our marketing spend). I was also reviewing our online metrics today, and have noticed that we have had the best engagement and view rates across all our channels. We have also begun utilising LinkedIn to share more content this month, which will expand our brand further. I firmly believe our approach to an integrated marketing strategy with content generation at the centre has had a positive impact.

Unfortunately, our trend is completely counter to what we are seeing in the market insights data (see below) we report on. This data is showing an increase in costs (presumably due to more competition), while Return On Ad Spend (ROAS), conversion value, and in-store visits all dropped again in June. We are in the process of updating our reporting for this, and hope to drill further into the data over the coming months.

We have been working on the release of our new website for the last 6 months and with over 160 pages created, we have now soft launched the site. Earlier this year we purchased webwonks.com for $3000 USD (down from the $10k we were originally quoted!!) We will be switching our .co.nz over to the .com domain in the next week or so.

With our ongoing commitment to generating useful content across all channels, we will publish our monthly walkthroughs on the new website. This month we added 4 new walkthroughs for our clients and the public alike:

>> How to add Essential SEO elements to a Wordpress Site Page

>> How To Use The Google Ads Performance Planner

>> Creating Custom Reports In GA4

>> Using The Best Seller Report In The Google Merchant Centre

Over the course of the next 6 months we will review our historic How-To Guides on our website, refreshing them to meet current best practice.

Google released a new transparency report this month which will be useful for competitor analysis. It does seem a bit wonky and may take a few months to release better data, however, I do recommend giving it a try - https://adstransparency.google.com/?region=NZ

Finally, if you are interested in our new internal training program, and how we are rolling it out with all our team members, please take a look at my CEO Memo video.

Jeff

Our New Fleet Vehicles

What is Google Merchant Center?

Market Insights

Last year we started the process of aggregating client data into anonymised reports that allowed us to provide insights into a slice of the market’s ad spend, and subsequent number of conversions and revenue. This was well received, but we want to keep working on how we better deliver insights to our clients.

One way of doing this is to integrate Google Analytics and Google Cloud to better handle larger queries and insights. To do this, we will need to make additions to your Google Tag Manager account to send data from GA4 to Google Cloud - this process will begin in July.

Overall Metrics:

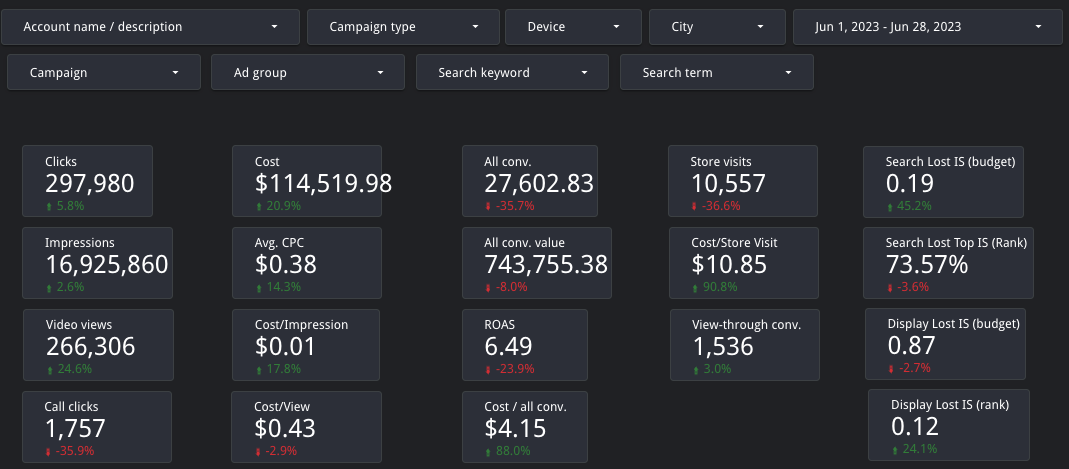

The details below highlight the Google Ads Performance from 1st June 2023 to 28th June 2023.

In comparison to the previous year for the same period, the cost increased by 20.9%, and the average cost per click increased by 14.3%.

Overall conversion value reduced (by 8.0%) in June 2023 compared to the previous year and ROAS reduced by 23.9% and is at 6.49 for the month so far.

Store visits have also decreased by 36.6% Year on Year, slightly better than last month’s 44% drop. The cost per impression for the ads increased by 17.8%.

Return On Ad Spend Metrics

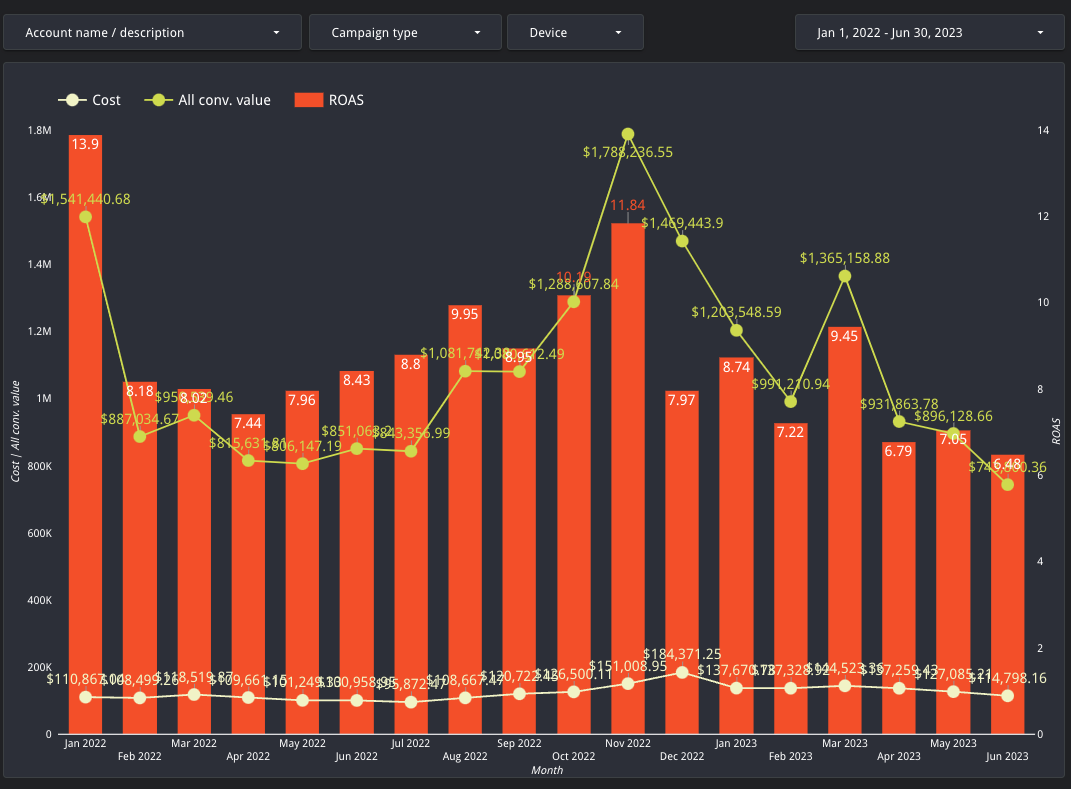

The graph chart below highlights the ROAS trend over the past year.

The trend line continues to drop for June 2023 performance for the ROAS figure at 6.49, which is again the lowest since January 2022. The total revenue from Google Ads is also the lowest at $743k in June 2023 so far. Based on the last year's performance, we anticipated June 2023 to perform better than May, but it has continued to reduce in ROAS and revenue metrics. July’s performance last year was better with 8.8 ROAS but with the given market turmoil we anticipate July 2023 to provide an ROAS close to 7.